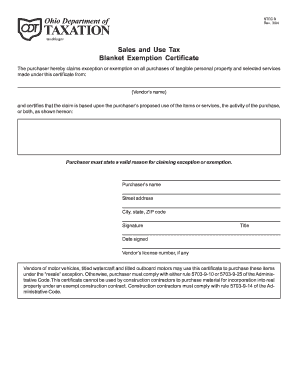

ohio sales tax exemption form 2019

A good example is Bethanys soap-making business. Hamilton County collects on average 153 of a propertys assessed fair market value as property tax.

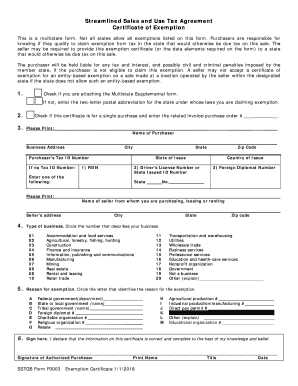

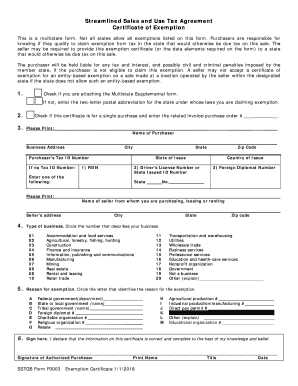

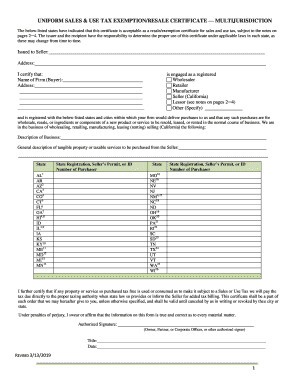

Sstgb Form F0003 Fill Out And Sign Printable Pdf Template Signnow

The value of the exemption may not exceed the value of the homestead.

. The New York state sales tax rate is 4 and the average NY sales tax after local surtaxes is 848. Counties and cities can charge an additional local sales tax of up to 4875 for a maximum possible combined sales tax of 8875. New York has 2158 special sales tax.

Effective July 1 2019 if issued pursuant to a prescription and for a human being the sale of corrective eyeglasses or contact lenses are not subject to the tax. If a Tennessee supplier sells tangible personal property or taxable services to an out-of-state dealer for resale and drop ships the goods to the out-of-state dealers Tennessee customer after January 10 2022 the Tennessee supplier may accept a resale certificate issued by another state or a fully completed Streamlined Sales and Use Tax Exemption Certificate that. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

Prior to July 1 2019 all sales of corrective eyeglasses or contact lenses are subject to the tax unless a specific exemption or exception applies. Click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements are for example many states require a Government ID or a form. The 2017 income threshold is 31800 the 2018 threshold is 32200 the 2019 threshold is 32800 the 2020 threshold is 33600 and the 2021 threshold is 34200.

Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes. Businesses still must pay a sales tax on goods used for its business the exemption is only for goods it buys and resells. Most states accept the Uniform Sales Use Tax Certificate as a reseal form but some states require special ones.

The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200. Please note that the tax exemption information provided is the most current information as of the date indicated on each individual State map page bottom left. Groceries prescription drugs and non-prescription drugs are exempt from the New York sales tax.

Ohio has a state income tax that ranges between 285 and 4797 which is administered by the Ohio Department of TaxationTaxFormFinder provides printable PDF copies of 83 current Ohio income tax forms. She buys the ingredients to make her soap from local farms and producers. The tax exemption is limited to the homestead which Ohio law defines as an owners dwelling and up to one acre of land.

Michigan Sales Tax Exemption For Manufacturing

How To Get A Sales Tax Exemption Certificate In Utah

Tx Comptroller 01 315 1991 2022 Fill Out Tax Template Online Us Legal Forms

Fill In Blank Tax Exemption Form Ohio Fill Online Printable Fillable Blank Pdffiller

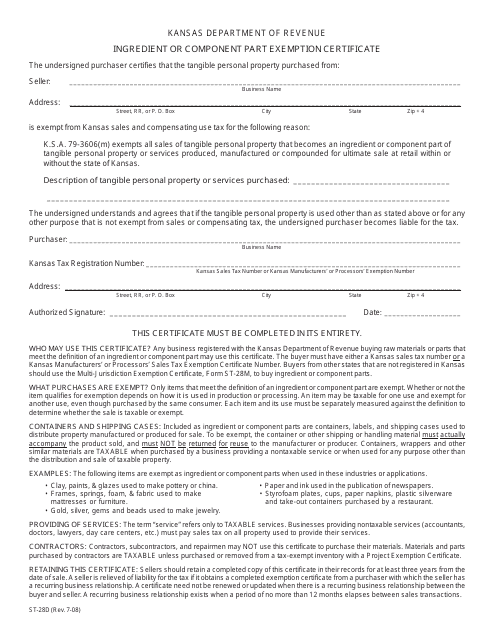

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Printable Ohio Sales Tax Exemption Certificates

Printable Ohio Sales Tax Exemption Certificates

Sc Pt 401 I 2019 2022 Fill Out Tax Template Online Us Legal Forms

Fill In Blank Tax Exemption Form Ohio Fill Online Printable Fillable Blank Pdffiller

New Bulletin Explains Ohio S Sales Tax Exemptions For Agriculture Farm Office

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

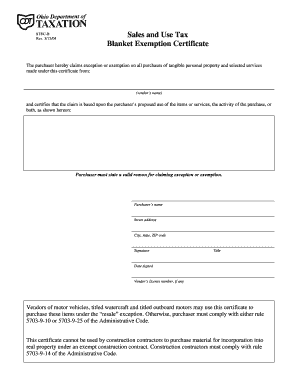

Get And Sign Uniform Sales And Use Tax Certificate 2019 2022

2015 2022 Oh Stec B Formerly Stf Oh41575f Fill Online Printable Fillable Blank Pdffiller